Capital transactions

from Series A to late-stage venture

M&A

Sell-side and Buy-side advisory services

From Waga's Series A to it's IPO

2019 to 2023

We at Apparius, had the chance to support Waga Energy over a substantial part of their financial journey.

In 2019, we assisted the company in securing a €10 million funding round from investors including ALIAD, Ovive, Starquest, Noria, and Tertium. This funding supported Waga Energy's international expansion and development of their WAGABOX® technology.

Building on this success, we remained the founders' advisors for their €126 million initial public offering on Euronext Paris in October 2024. The IPO was success, providing Waga Energy with the capital needed to accelerate its expansion and solidify its position as a European leader in biomethane production from landfill gas

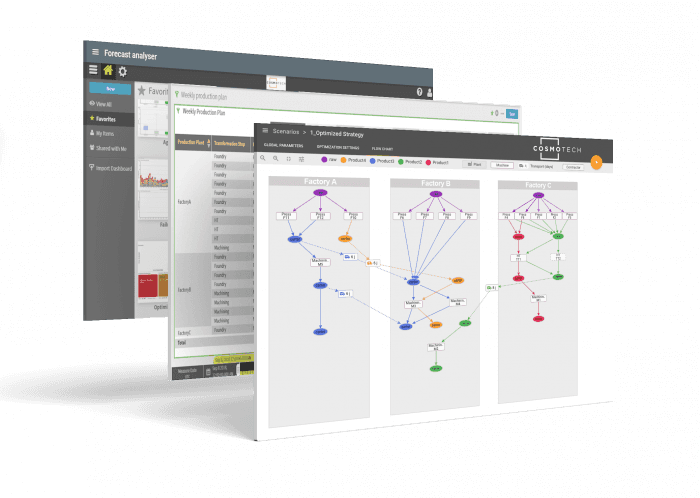

From Series A to C for CosmoTech

2014 to 2022

Since 2014, we have provided advisory services to Cosmo Tech, a specialist in complex system modeling and simulation.

In 2014, we raised a €4M Series A from Total, Aster and UI, supporting their early technological and geographic expansion.

A €18M Series B in 2017 brought Inven, Cathay and Cemag onboard, to enable Cosmo Tech to scale their platform and increase their workforce.

Most recently, in 2018, they welcomed Accenture Ventures with a €15M Series C round.

From eNovance's first fundraising to its $100M exit

2010 to 2014

In 2010, eNovance initial €3M Series A was one of Apparius's first assignment, bringing Odyssee Venture onboard the capital of this open-source cloud orchestration specialist.

In 2013, we supported the company in a non-dilutive €6M fundraising, notable bringing Entrepreneur Venture onboard and providing the company with the means to leverage it's growing reputation in the Open Stack community.

In 2014, in a dual track process, we advised the company on it's $100M exit to Red Hat Inc, in what remained a landmark transaction for the open-source community.